- W3VE Web3 Hub

- Posts

- Billionaire Michael Saylor says that if you hate money, short Bitcoin.

Billionaire Michael Saylor says that if you hate money, short Bitcoin.

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Bitcoin hits record high of $123,000:

This week was so big in crypto, that analysts are calling it “Crypto Week”.

Why this week being dubbed crypto week:

The main reason is due to the continuous passing of crypto-related bills by the US, which will increase the adoption of blockchain fintech mechanisms such as stable coins and Bitcoin itself - this therefore breeds consumer confidence and therefore entices people to buy more Bitcoin.

A big reason why the price of Bitcoin has increased is due to the fact that crypto ETF’s are easily acceptable now. Previously, buying crypto was still a bit underground for the average user as they didn’t necessarily trust exchanges (thanks FTX), but having players like BlackRock and JP Morgan who have their own crypto ETF’s allow low friction entry points for the average individual who wants exposure to the crypto markets.

Whales like Michael Saylor and Justin Sum are buying up massive positions in crypto (Saylor’s company, MicroStrategy, bought $472.5 million of Bitcoin last week and Sum bought $100 million of $Trump coin last week.)

Crypto influencer, “Pomp”, states that Bitcoin is in a class of it’s own given the 100% increase in value from 2024.

2) Coinbase hits $100 billion market cap:

It feels like they just spawn out of no where.

Coinbase’s stock closed on Monday at $394.01 per share and hence giving the company a market cap of $100 billion dollars.

The new trend that follows is treasury companies:

Treasury companies serve to facilitate investment opportunities for private individuals interested in gaining exposure to BTC in a world where regulation does not allow for this to happen.

Coinbase’s non-transactional-based revenue has steadily risen to $772 million in the 1st quarter of 2025. In comparison, Robinhood’s non-transactional-based revenue was $334 million dollars after the first quarter of 2025.

Analysts say that Coinbase is the “Amazon of Crypto”. To be honest, I see it. Brian Armstrong and Jeff Bezos are both beautiful, bald and powerful.

Spot the difference

3) There’s a new Web3 sector trending:

It feels like they just spawn out of no where.

So, traditionally, the most common narratives are DeFi (decentralized finance - which is building a bankless financial system where there is no need for third party intermediaries), DePin (decentralized physical infrastructure network - which is hardware and software required to ensure that the blockchain actually works), and digital asset (like NFT’s - pixel monkey).

The primary reasons for the increase in valuation:

Bitcoins rise to new all-time-high this weekend … Duh

Coinbase’s shares have surged over 50% this past month due to the wildly successful IPO of Circle Internet Group.

The positive regulatory developments in the US.

The trend at hand:

11 Public Eth treasury companies, of which five were started last month

7 Public Sol treasury companies

Wait for it… 148, yes! 148 public BTC treasury companies, which cumulatively hold $103 billion in Bitcoin.

By investing in crypto, these companies get diversification benefits as their company would be inverse to crypto, they hedge against inflation and they mitigate inflation risk.

Growth Marketing Tip of the Week

70% of Calvin Klein’s tweets are questions

100% of Ralph’s Lauren’s tweets are statements

The result:

Write tweets to get replies

Don’t write at the reader. Involve them.

Recently Funded Companies

Meme’s of the Week

I refuse to see any red for the next month

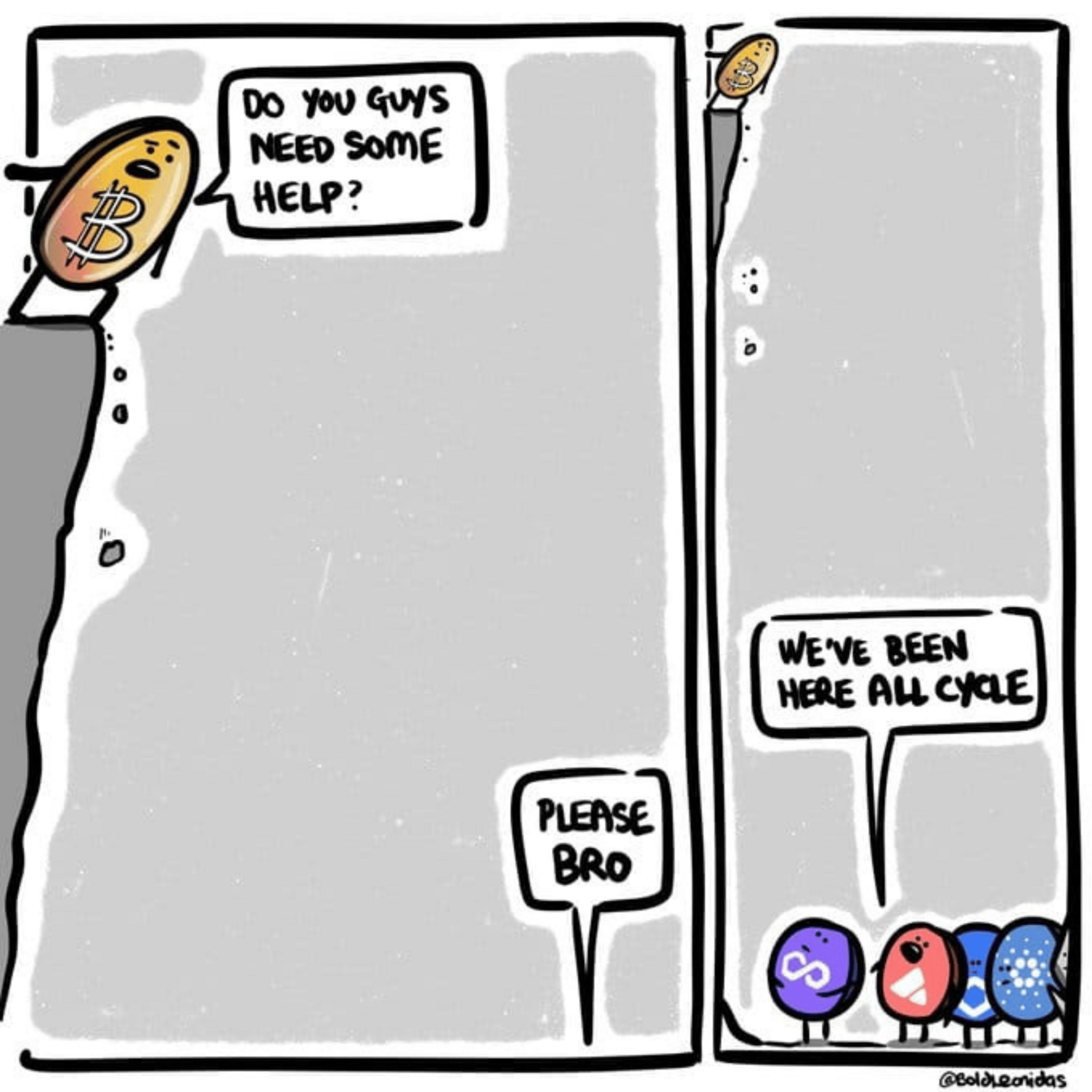

Poor alt coins…

🙃

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!