- W3VE Web3 Hub

- Posts

- Bitcoin is worth more than your search history

Bitcoin is worth more than your search history

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

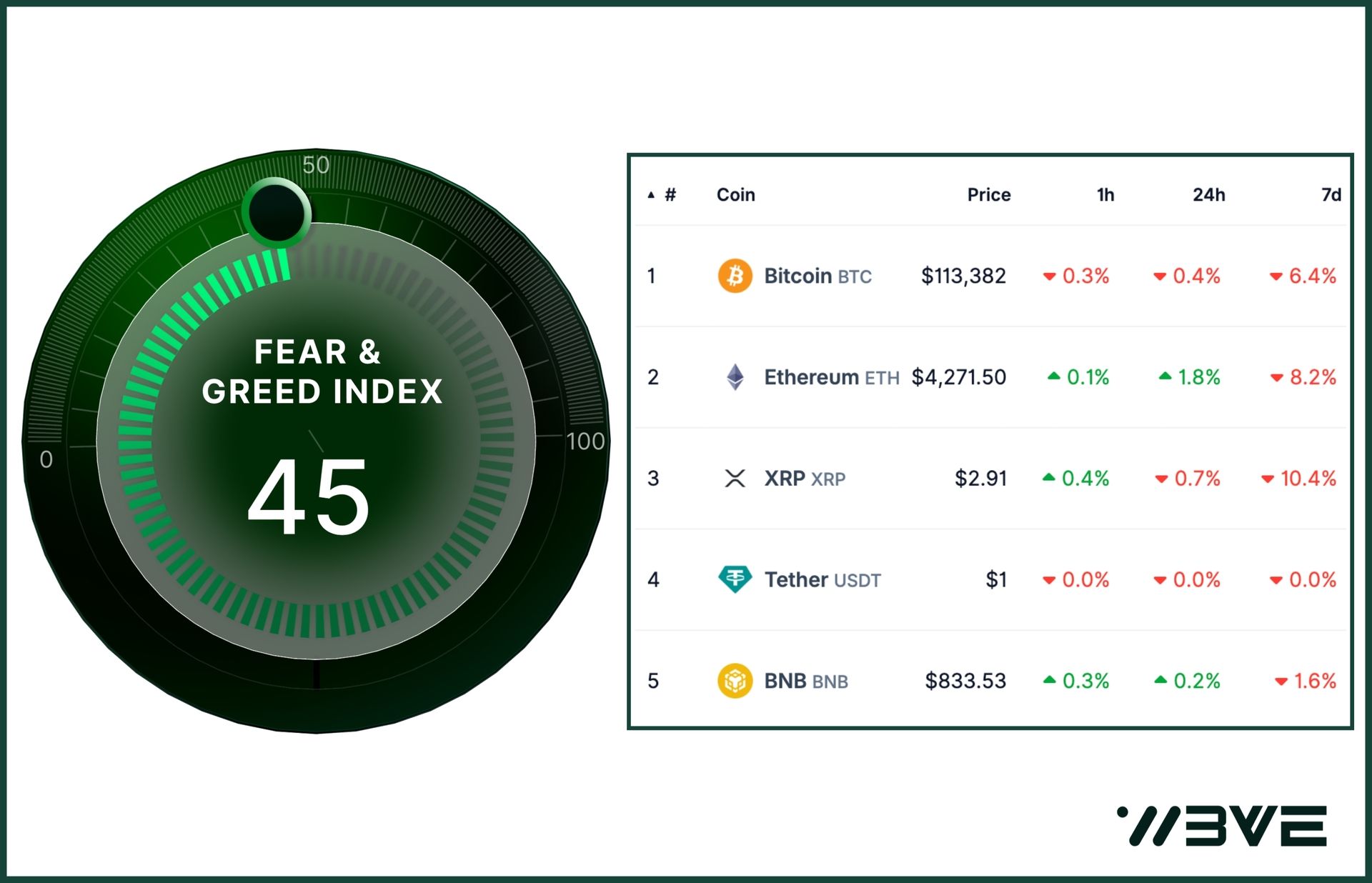

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Bitcoin is worth more than your search history

Bitcoin just pulled off a serious coup: it briefly leapfrogged Google’s parent company, Alphabet, hitting a jaw-dropping all-time high of $124,457. That move pushed its market value above $2.45 trillion - enough to crown it the fifth-largest asset in the world. Somewhere in Silicon Valley, a Google intern probably spilled their coffee.

The surge sparked waves of investor euphoria, with crypto die-hards declaring this the “best week for Bitcoin” (and it's not even Friday). Social media lit up like a Christmas tree - because apparently nothing gets people going like digital coins taking off.

But this isn’t just retail hype - Bitcoin’s growth is being powered by the big dogs. Institutional investors (aka the people in suits) are pouring in, thanks to clearer rules, favorable economic winds, and game-changing shifts like crypto sneaking into retirement funds. Yes, your grandma’s 401(k) might now include a slice of Satoshi.

All this action pushed the entire crypto market cap over $4.1 trillion for the first time ever. With eyes now set on Apple’s $3.4 trillion throne.

Source: https://x.com/coingecko

2) Cash is Cringe: Spar Lets You Shop Swiss Groceries with Crypto

Who needs cash when you’ve got crypto? Spar is shaking up Swiss supermarkets by accepting Bitcoin and Stablecoins at checkout.

Teaming up with Binance Pay and Swiss fintech firm DFX.swiss, Spar is rolling out crypto and Stablecoin payments across 300 supermarkets. The service is already live in over 100 stores and will expand across the rest of Switzerland in the coming months - although there’s no official “when” yet. You know, Swiss precision… except for timelines.

This marks Switzerland’s first nationwide crypto checkout system in grocery retail. Translation: crypto has officially leveled up from speculative asset to “acceptable payment for snacks.”

Shoppers can pay using over 100 different cryptocurrencies and stablecoins. The process is simple: scan a QR code using the Binance Pay app, choose your favorite coin, and voilà - your Dogecoin just became dinner. Behind the scenes, your crypto gets instantly converted into Swiss francs, so Spar still gets paid in good old fiat (and doesn't have to worry about price swings every time Elon tweets).

Also, merchants aren’t just doing this for fun, crypto payments could cut their card commission fees by up to two-thirds. In other words, fewer middlemen, more savings, and possibly more room in the budget for that fancy Swiss cheese.

Oh, and it’s gas-free, hence there’s no blockchain transaction fees passed to the shopper. Just smooth, clean, digital payments… like it’s 2025 or something.

3) Ether steals the spotlight: While Bitcoin hits all-time-high, ETH hits all time high

While everyone was busy celebrating Bitcoin’s new all-time high of $124,000 and flexing price charts on social media, Ether was busy doing what it does best: dominating quietly - but with $2.9 billion worth of receipts.

Crypto investment products saw another big week of inflows, and Ether exchange-traded products (ETPs) ran away with the crown. While Bitcoin ETPs brought in a respectable $552 million (a humble 15% of total weekly inflows), Ether casually pulled in $2.9 billion, reminding everyone that it’s not just the other crypto anymore.

Even though ETH hasn’t broken its previous all-time high yet (sitting just under $4,700), investor appetite has clearly shifted. Ether ETPs are eating, and they’re not leaving crumbs.

In fact, last week saw the highest trading volume ever for spot crypto ETFs -hitting $40 billion in just four days. According to analysts, Ether ETFs did a lot of the heavy lifting. One expert even called it “ETHSANITY.” And honestly? Fair…

But the hype didn’t last forever. After four bullish days, sentiment cooled, and both Bitcoin and Ether saw outflows by Friday. The crypto market does love a dramatic mood swing.

Still, the streaks speak for themselves: Ether ETFs have racked up $3.7 billion in inflows since August 5 in an 8-day run, while Bitcoin ETFs saw a shorter, 7-day streak with $1.3 billion. Looks like Ether’s playing the long game.

Hopefully, it’s only green from here.

Growth Marketing Tip of the Week

The marketing funnel is a strategic model that outlines the stages a potential customer moves through before making a purchase and becoming a loyal advocate.

It begins with Awareness, where individuals first encounter a brand through channels like social media, search, or advertising - this stage is about visibility and capturing attention.

Next is Consideration, where prospects actively evaluate your offering, comparing it to alternatives and seeking more information through content like case studies, reviews, or email nurturing.

Conversion follows, where the focus shifts to removing friction and prompting action, using clear calls-to-action, optimized landing pages, and compelling value propositions.

Loyalty emphasizes customer retention and relationship-building post-purchase through exceptional service, personalized communication, and value-added experiences.

Each stage requires tailored strategies to move prospects efficiently down the funnel, optimize ROI, and build long-term brand equity.

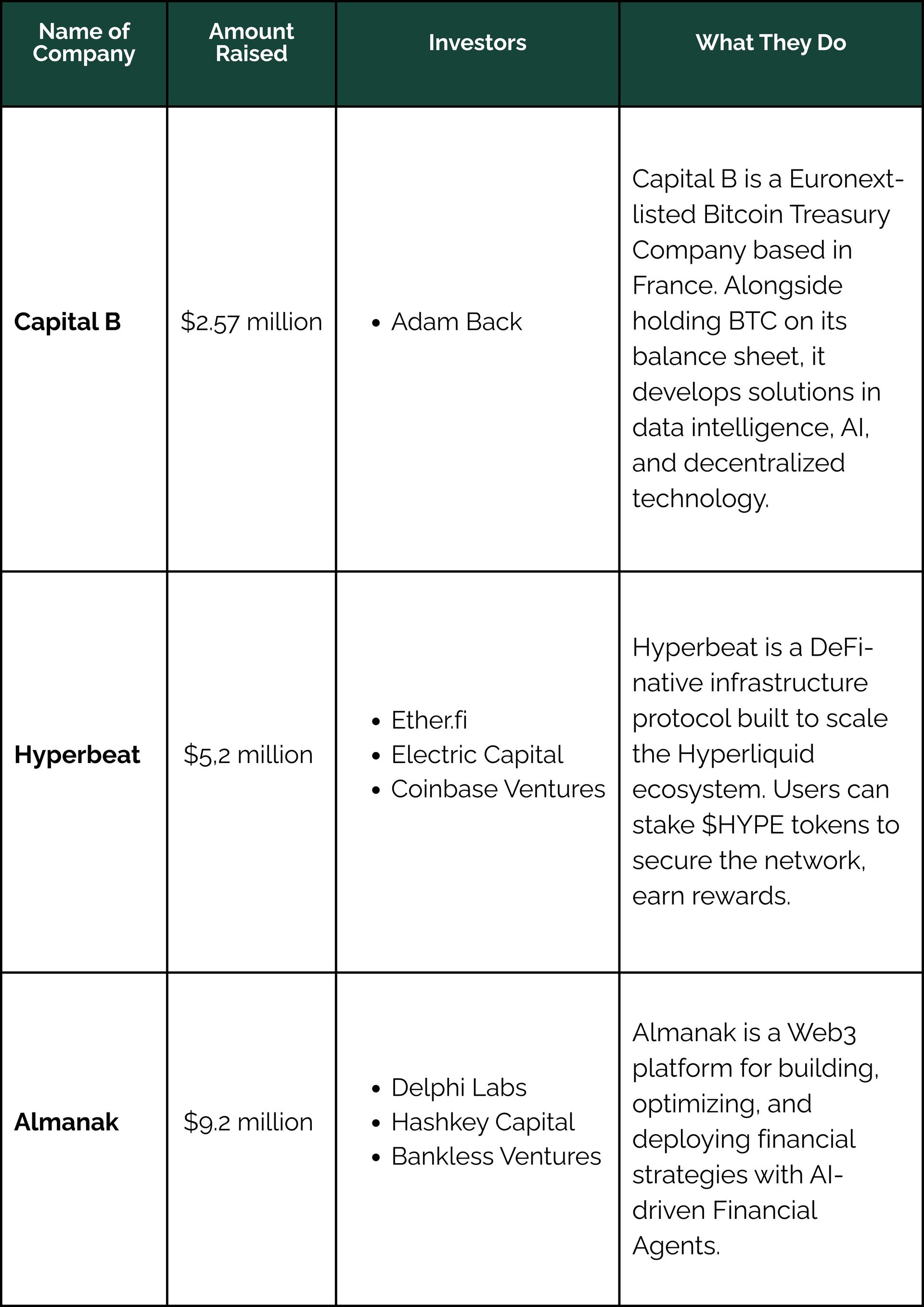

Recently Funded Companies

Meme’s of the Week

200k coming up next!!!!

Retail investors… are you okay?

Bull run time!!!

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!