- W3VE Web3 Hub

- Posts

- Blockchain is saving the world: Here’s how it stopped 394M tons of CO2

Blockchain is saving the world: Here’s how it stopped 394M tons of CO2

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

You know how a truly smart home just works? You flip a switch, and the lights come on. You tell it to play music, and it does. You don't have to rewire anything or dig through manuals – the infrastructure is just seamlessly there, making your life easier and more rewarding.

That's pretty much what StakingCabin does for your Proof-of-Stake (PoS) assets. They provide the rock-solid infrastructure that takes all the fuss out of staking. Instead of wrestling with complex setups or worrying about security, you can simply let StakingCabin handle the heavy lifting, allowing your digital assets to safely earn rewards.

It’s no wonder big names like SUI, Aptos, IOTA, and Monad trust them. They've built a reputation for making staking effortless and secure.

Ready to make your digital assets work smarter, not harder?

Do your company a favour – trust StakingCabin as your validator.

Do your assets a solid – trust StakingCabin as your staking provider.

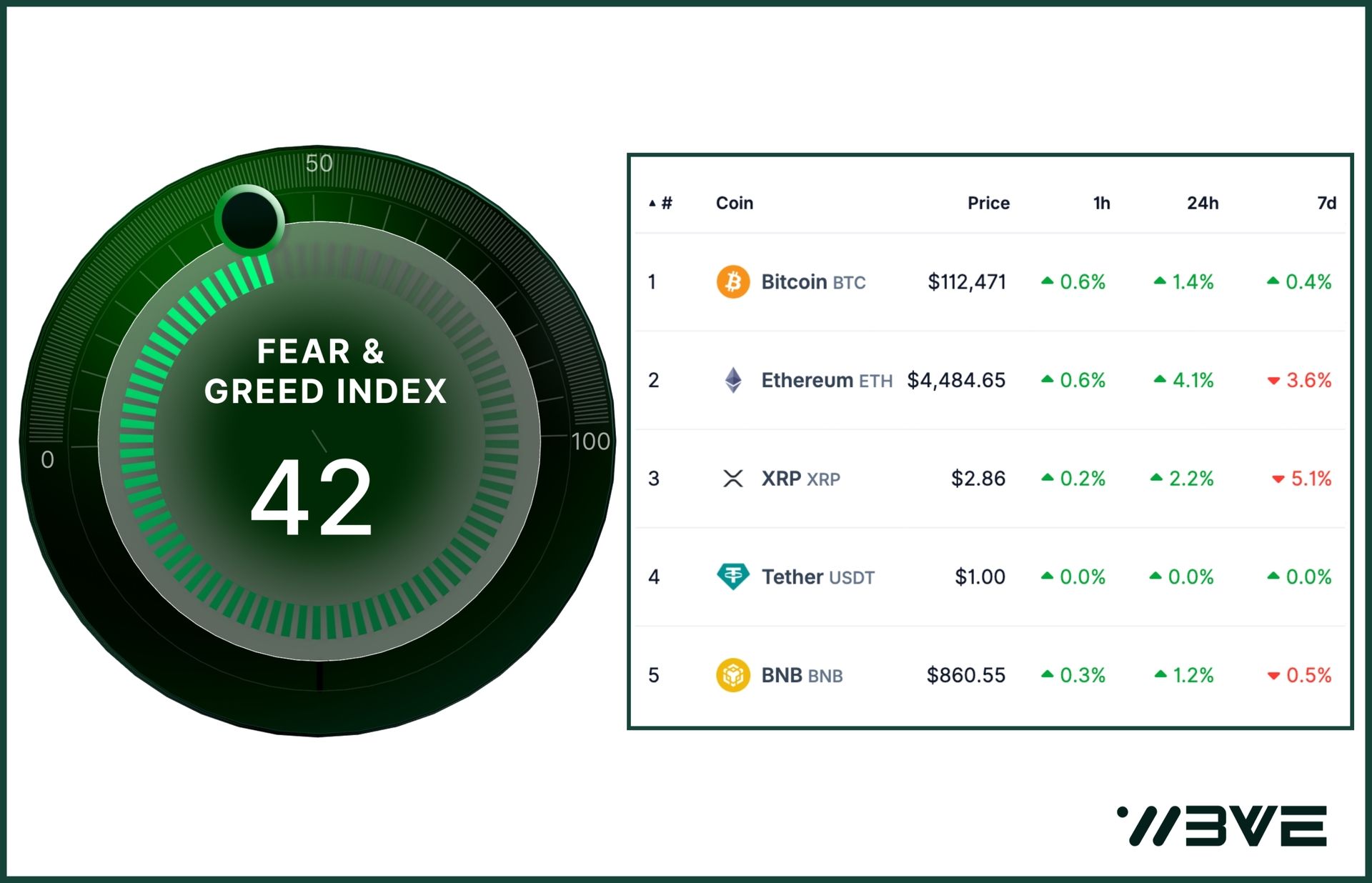

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Blockchain tokenization prevents 394M tons of CO2

Move over meme coins—blockchain just found a way to stop the planet from cooking. Wealth tokenization platform Arx Veritas and infrastructure firm Blubird have teamed up to prevent nearly 400 million tons of CO₂ emissions, which is basically the blockchain equivalent of slapping duct tape over climate change’s mouth.

So how does it work? By turning emission reduction efforts into an investable asset class, tokenization unlocks institutional capital that wouldn’t normally flow into these projects. The result: more wells capped, more coal mines closed, and thus more CO₂ prevented from ever hitting the atmosphere.

They pulled this off by tokenizing $32 billion worth of Emission Reduction Assets (ERAs) on Blubird’s Redbelly Network. In simple terms, they’ve taken capped oil wells and coal mines, normally symbols of environmental doom, and turned them into digital tokens that finance sustainability instead of spewing pollution. It’s blockchain, but with a green conscience.

The scale of this effort is wild. Those 394 million tons of emissions prevented equal almost 395 million round-trip flights from New York to London, nearly a trillion miles driven in an average car, or 105 times the yearly CO₂ emissions of Iceland (sorry Björk). Not exactly small numbers.

And they’re not stopping there. Blubird says institutional investors are lining up, with another $18 billion worth of deals in the works. If that pipeline comes through, we’re looking at a grand total of 600 million tons of CO₂ emissions prevented—enough to make carbon itself pack its bags and leave.

So maybe the future of sustainability isn’t just solar panels or electric cars. Maybe it’s turning pollution into tokens. Who knew blockchain’s biggest flex wouldn’t be apes, coins, or scams… but saving the planet?

2) The Sandbox co-founders ousted from exec roles amid mass layoffs

Remember when The Sandbox was supposed to be the future of digital real estate, where people would pay millions to own a pixelated plot next to Snoop Dogg? Well, that future just got a serious reality check.

According to TheBigWhale newsletter, The Sandbox is being gutted and restructured by its parent company, Animoca Brands. Translation: they hit Ctrl+Alt+Del on their metaverse land game. More than half of its 250 employees have been laid off, and the game’s co-founders, Sébastien Borget and Arthur Madrid, have been quietly moved into new, less powerful roles.

Who’s running the show now? That would be Animoca CEO Robby Yung, who was appointed The Sandbox’s new CEO about two weeks ago. Meanwhile, Borget has been handed the title of “ambassador,” which is basically corporate-speak for “professional spokesperson,” while Madrid has been given the lofty but vague “chairman” role. Both co-founders technically “remain deeply involved,” but insiders say they no longer have any real executive power. Ouch.

Borget, ever the optimist, reportedly told TheBigWhale: “I remain the person who best represents The Sandbox around the world.” That’s one way of saying: “I don’t run the place anymore, but I’ll still show up at conferences with a branded hoodie.”

So why the shake-up? Animoca hinted in a statement that generative AI might have something to do with it. Which makes sense, why pay hundreds of people to design pixel worlds when ChatGPT’s cousin can do it in seconds? The metaverse promised us digital land, but it looks like AI is now bulldozing the construction crews.

In the end, The Sandbox isn’t disappearing, it’s just being rebranded, restructured, and rebuilt. Whether this revival turns it into the bustling metaverse hub we were promised or just another crypto ghost town remains to be seen. For now, let’s just say the Sandbox dream is… under renovation.

3) James Wynn wiped out on a 10x Doge bet

Crypto millionaire James Wynn isn’t done with the market, even if the market seems very, very done with him. Despite a string of painful liquidations, Wynn insists the August downturn is ending, and he’s not backing down from the memecoin battlefield.

His latest hit came from a 10x leveraged long on Dogecoin (DOGE), where he lost a modest $22,627, according to blockchain tracker Onchain Lens. Modest, of course, compared to Wynn’s $100 million leveraged position that got nuked back in May when Bitcoin briefly dipped below $105,000. Ouch.

Wynn blames it all on a shadowy group of market makers he calls the “memecoin cabal.” In his view, they orchestrate pump-and-dump schemes, wipe out leveraged longs, and feast on unsuspecting traders like digital vultures. “Fuck the memecoin cabal, you give them supply and they just dump on your head. They’re thieving scavengers,” Wynn raged on X. His solution? Launch his own meme coins, where key opinion leaders (KOLs) “get precisely zero.” Translation: if anyone’s going to dump on you, it’ll be him.

According to Hyperdash data, Wynn has racked up about $21.7 million in realized losses on a single Hyperliquid account since March 19. The carnage includes a $1 million wipeout in July on his 10x leveraged Pepe (PEPE) long, which was worth over $11 million when opened. That position didn’t age well.

Growth Marketing Tip of the Week

The story starts in California. 1981.

Charlie Munger hires Chet Holmes to sell magazine ads. He's given a list of 2,200 potential advertisers and a bunch of flyers.

Chet doesn’t send one flyer.

Instead he backorders hundreds of issues of competitor magazines. And realises 167 companies are responsible for 95% of all ad sales.

So Chet ditches the list and goes all-in on the 167. Free gifts, lunches, dog-eared determination.

A few months later Xerox order 104 full-color spreads. “The biggest deal in the history of the industry”.

In three years Chet takes the magazine from 16th in the market to double their closest competitor. At this point Munger calls him into his office.

“Now Chet. In all my years, I’ve never seen anybody double sales three years in a row. Are you sure we’re not lying, cheating, and stealing?”

He wasn't. The Dream 100 was born.

“Write down your dream 100 clients. Do anything you can to win them.”

I've seen hand-delivered briefcases, carrier pigeons, gifted typewriters, watercolor art, YouTube call-outs, fedexed phones that “will ring at 3pm”.

When you're negotiating with millionares nothing is off the table. Let me tell you the Walt Batansky story...

So Walt is CFO at Avocat. For months the sales team have been going after a publically traded medical company. Crickets and tumbleweed.

Walt reads in the Wall Street Journal that they're having a shareholders meeting a month out. So he buys 100 shares ($6 each).

That gets him an invite and he flies to their headquarters in Jacksonville, FL.

The presentation ends, a receiving line forms, the CEO works his way down, Walt senses his moment.

“I'm a shareholder, I've reviewed your annual report, and I'm convinced I can show you how to save several million dollars on real estate.”

The CEO is taken aback. But gives Walt the name of their executive who handles properties. Walt calls. “Your CEO put me in touch.”

The entire sales team are invited to present. They become Avocat's single largest account overnight.

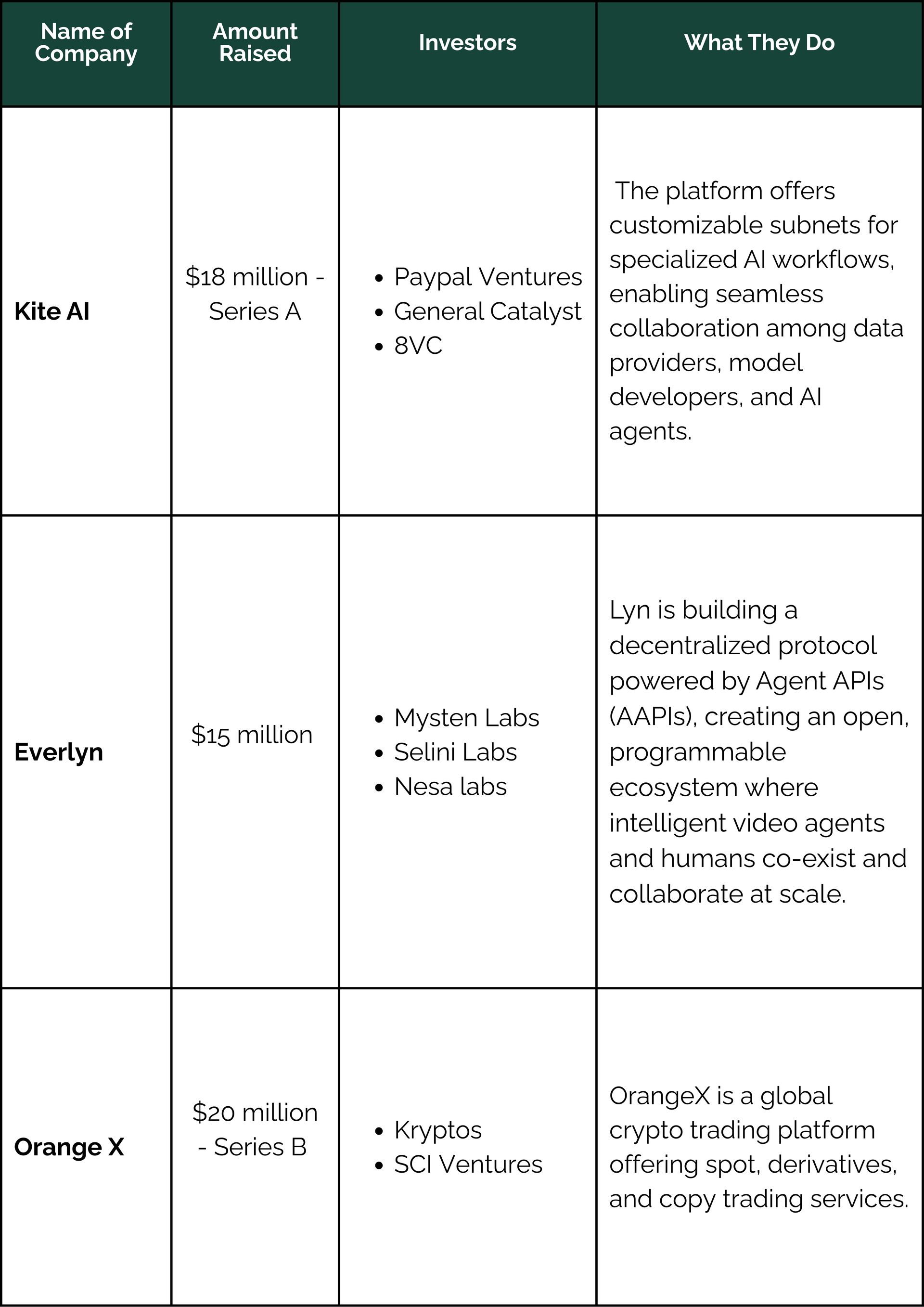

Recently Funded Companies

Meme’s of the Week

😆

KOL prices are crazy!!!!

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!