- W3VE Web3 Hub

- Posts

- Crypto is one "growth cycle" away from mainstream adoption (says credible source)

Crypto is one "growth cycle" away from mainstream adoption (says credible source)

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Crypto is one growth cycle away from mainstream adoption

Crypto might be just one good market cycle away from going full global takeover, like the Beatles in the ’60s, but with blockchains and memes. According to Thomas Prévot from Crypto.com, we’re not just talking about nudging toward mainstream use with 1 billion users. Nope. He’s swinging for the fences: 5 billion crypto users within the next ten years. That’s basically most of the adult population of the planet paying for groceries, subscriptions, and probably weird digital pets using crypto. And he’s serious. “We’re one cycle away,” Prévot said at the Waib Summit 2025 in Monaco, casually dropping the idea that crypto could become as common as swiping a credit card, except hopefully with fewer surprise overdraft fees. By the end of 2025, an estimated 659 million people already held some kind of crypto, which is a wild leap from just a few years ago when owning Bitcoin was still considered a quirky Reddit hobby.

But how do we leap from internet money to literal worldwide adoption? According to Roy van Krimpen from OKX, there are two possible roads to crypto domination: the fast one and the slow one. The fast one? Good old-fashioned retail speculation, basically, people FOMO-ing in during a bull run like it’s 2021 all over again. Back then, the market quadrupled in a few months just because people didn’t want to miss the next Dogecoin moment (maybe it’s Trump coin this time around). The slow route, van Krimpen explained, is through actual blockchain utility… boring… like using crypto for payments, remittances, or buying that overpriced latte without involving 17 middlemen and a bank. That path takes longer because it requires people to actually change their behavior. And let’s face it, convincing people to switch financial systems is slightly harder than convincing them to try a new burger at KFC.

Meanwhile, tech insiders like Coinbase’s Chintan Turakhia believe that crypto needs a major UX glow-up before it can truly hit the mainstream. Right now, using crypto can feel daunting—there’s jargon, seed phrases, and the constant fear of sending money to the wrong address forever. But as more beginner-friendly platforms emerge and blockchain apps become as intuitive as scrolling through TikTok, hitting the first billion users becomes way more realistic. And if that happens? Well, crypto OG Willy Woo predicts Bitcoin could skyrocket to a casual $700,000 per coin, assuming just 3% of global portfolios get allocated to BTC. That’s a big “if,” but not impossible if crypto keeps evolving from speculative chaos into something people actually trust and use. So whether we’re one hype cycle away or just one killer app short, the race to global crypto adoption is officially on. And who knows? In ten years, paying in fiat might feel as old-school as writing a check.

2) Crypto.com and underdog partner up to launch sports prediction market

The world of crypto and fantasy gaming just got a little more exciting. Underdog is teaming up with Crypto.com to launch sports prediction markets in 16 U.S. states, mostly in places where traditional sports betting is still off-limits. This new type of market isn’t your usual sportsbook. Instead of betting against a bookmaker, users buy and sell shares in the outcome of sporting events, similar to trading stocks. As more people bet on one side, the price shifts, just like the stock market reacting to demand. “Prediction markets are one of the most exciting developments we’ve seen in a long time,” said Underdog CEO Jeremy Levine, confidently calling this the future of sports-based betting. And Underdog plans to be right at the center of it.

Underdog is the first major fantasy sports platform to explore this new territory, but they are definitely not the only ones. Competitors like Robinhood, Kalshi, and especially Polymarket are already making serious progress in the prediction market space. Polymarket, in particular, has been getting a lot of attention for its rapid growth and popularity, and its success is clearly sparking new competition. Even big names like FanDuel and DraftKings are now looking into this space. The entire industry seems to be realizing that prediction markets might be the next big thing, offering a blend of investment and entertainment that doesn't quite fit traditional definitions.

This move is especially strategic because it avoids some major legal roadblocks. States like California, Texas, and Florida, which are among the most populous in the U.S., do not currently allow legal online sports betting. In Florida, most gambling is controlled by the Seminole Tribe, which has strongly resisted any newcomers. However, prediction markets offered through federally registered platforms like Crypto.com Derivatives North America (CDNA) may be able to bypass state-level restrictions. CDNA is already registered with federal regulators, giving this model a real advantage. “We were the first to offer sports events contracts, and our partnership with Underdog will expand access even further,” said Travis McGhee, head of capital markets at Crypto.com. Analysts estimate this market could generate over $500 million in revenue this year. If the trend continues, prediction markets could become one of the most significant shifts in sports, finance, and gaming in recent years.

3) Google advances its layer-1 BlockChain

Google Cloud is building its own blockchain, and no, it’s not to launch a meme coin. It’s called the Google Cloud Universal Ledger (GCUL), and it's being pitched as the Switzerland of blockchains, completely neutral and open to all financial institutions. While fintech giants like Stripe and Circle are busy developing blockchains to power their own ecosystems, Google wants everyone, even competitors, to use GCUL without worrying about giving someone else an edge. It even supports Python-based smart contracts, making it friendly for both financial engineers and everyday developers.

Unlike Stripe and Circle, which have clear in-house goals such as payments and stablecoins, Google’s blockchain is aiming for broader adoption with more diverse use cases like wholesale payments, settlement, and asset tokenization. Google and CME Group have already completed an initial integration, and full services are expected to launch in 2026. This could mean programmable money moving around the clock, faster collateral management, and no more delays just because it's the weekend and finance is out of office.

What makes GCUL especially interesting is its neutral positioning. Stripe brings its massive merchant network, Circle brings the global reach of USDC, and Google brings the scale of its cloud platform. With billions of users and trusted infrastructure, Google may be in the perfect spot to offer a blockchain that anyone can use without joining someone else’s walled garden. If it works, GCUL could quietly become the behind-the-scenes backbone for the future of digital finance

Growth Marketing Tip of the Week

Determine your north star.

2 months ago in a meeting, my CEO, Taryn stopped our meeting and asked, “what’s our north star?”, so naturally I looked outside at the sky to see if I was losing my mind but these 2 words shaped the way we conducted business.

The North Star framework is a product growth strategy that centers around one guiding metric that best reflects the value your product delivers to customers and drives sustainable business success.

To find your North Star Metric, identify the core value your product delivers, look at what successful users do, and choose one metric that best reflects that value and drives growth.

If you’ve built a strong North Star, someone should be able to read it and understand your company’s product strategy and your vision, at least at a high level.

We generally recommend that your North Star is unique to your business, expressing your company’s and your product’s strategy and mission. However, some businesses have a mission that’s not particularly differentiated and a North Star that doesn’t feel unique and that’s okay.

Example of how to determine your north star metric:

1) B2B North star: If you’re running a subscription-based product, you might consider annual revenue from subscribers your key metric, but it’s a lagging indicator.

Instead, a subscription-based business could identify characteristics that correlate with a user who is likely to renew their subscription and then build a North Star around that. If a user frequently runs a certain report showing the status of their customers, does that correlate to renewing a subscription? Perhaps that’s a hint that your North Star may be related to the information in that report.

Similarly, if a SaaS company has a self-serve business model like that of Dropbox or Hubspot, their metric might be “trial accounts with >3 users active in week 1 .” This metric captures all the new, free accounts that are getting value and providing a signal of future trial conversion and subscription revenue being generated that the product team can predict and drive.

(If you want a full course on this and other key aspects of web3 marketing, watch this space… W3VE’s got your back)

Recently Funded Companies

Meme’s of the Week

eish…

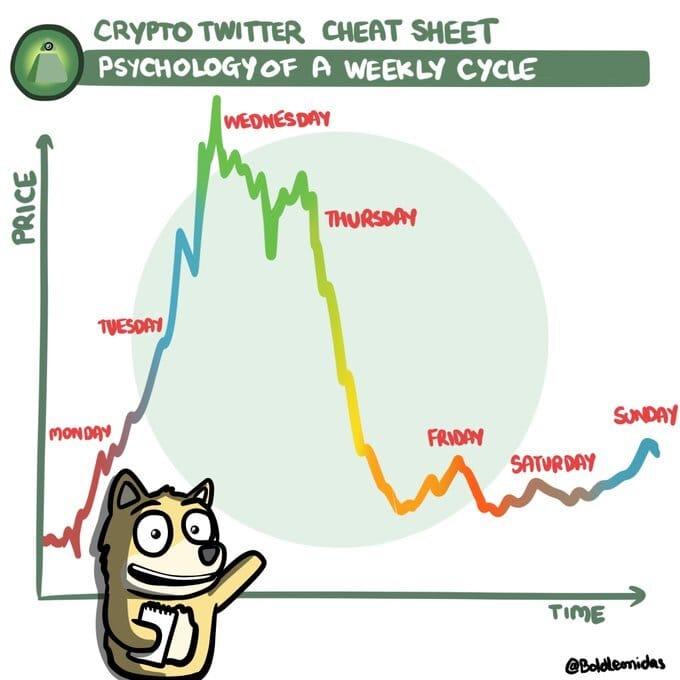

volatility hey

its a bubble

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!