- W3VE Web3 Hub

- Posts

- Crypto thefts in 2025 already top $2 billion, and the year’s not over!

Crypto thefts in 2025 already top $2 billion, and the year’s not over!

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

You know how a truly smart home just works? You flip a switch, and the lights come on. You tell it to play music, and it does. You don't have to rewire anything or dig through manuals – the infrastructure is just seamlessly there, making your life easier and more rewarding.

That's pretty much what StakingCabin does for your Proof-of-Stake (PoS) assets. They provide the rock-solid infrastructure that takes all the fuss out of staking. Instead of wrestling with complex setups or worrying about security, you can simply let StakingCabin handle the heavy lifting, allowing your digital assets to safely earn rewards.

It’s no wonder big names like SUI, Aptos, IOTA, and Monad trust them. They've built a reputation for making staking effortless and secure.

Ready to make your digital assets work smarter, not harder?

Do your company a favour – trust StakingCabin as your validator.

Do your assets a solid – trust StakingCabin as your staking provider.

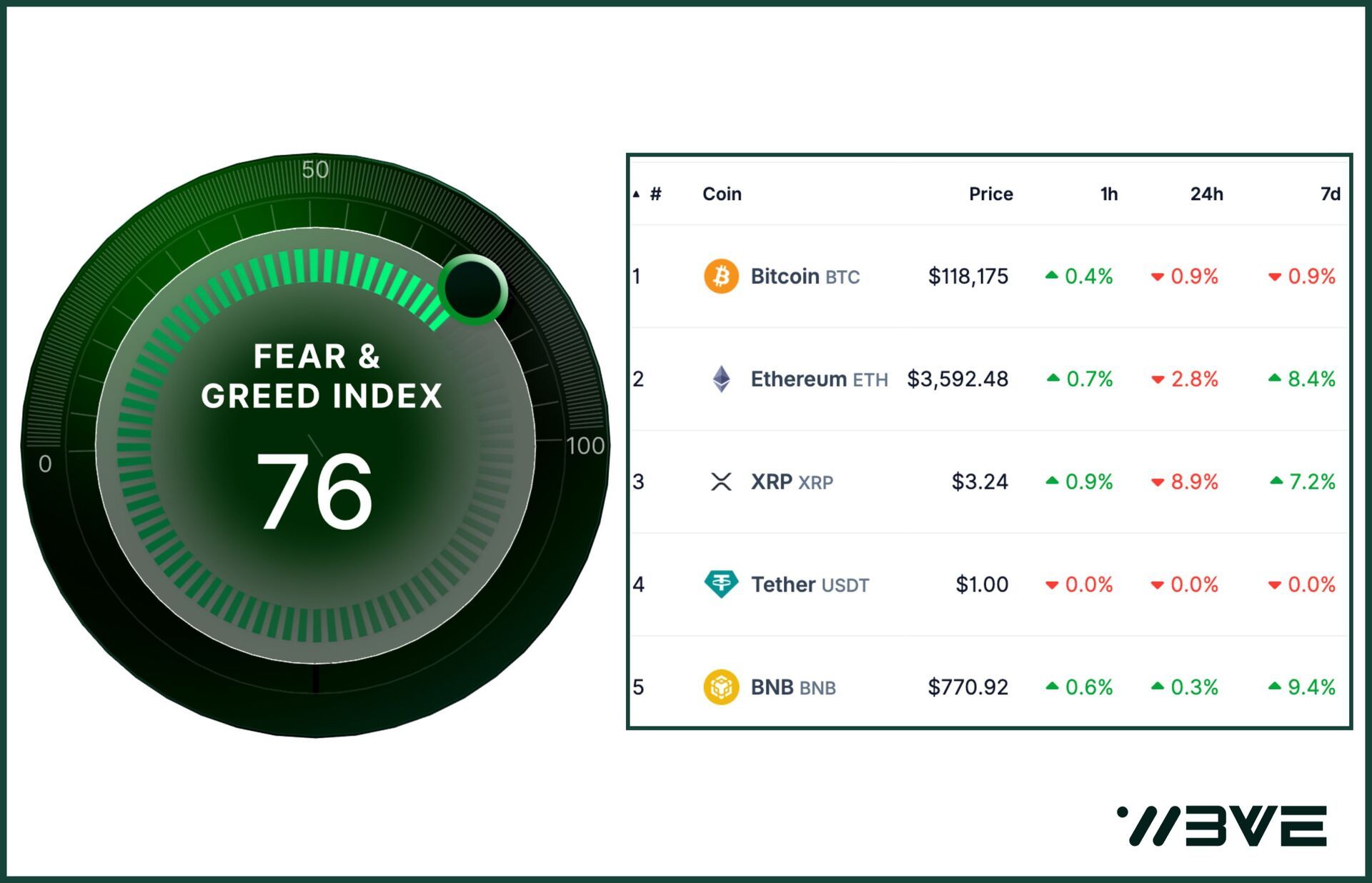

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Check your wallet … you may have been scammed.

On Friday, July 18th, Indian cryptocurrency exchange CoinDCX suffered a major security breach, resulting in the loss of approximately $44 million. The compromised funds were sourced from CoinDCX’s internal accounts used for liquidity provision, effectively, their working capital and operational reserves.

Importantly, customer assets remain secure. CEO Sumit Gupta reassured the community, stating: “The exposure was from our own reserves, and we have already absorbed the loss through our corporate treasury.”

In response, CoinDCX has rolled out a recovery bounty program aimed at incentivising white hat hackers to assist in asset recovery. The program offers up to 25% of any stolen funds successfully tracked and recovered, signalling the exchange’s proactive approach to damage control and community trust.

This incident is part of a growing and concerning trend. In recent years, centralised cryptocurrency exchanges have become prime targets for sophisticated cyberattacks. These are not isolated incidents, but indicative of systemic vulnerabilities as data shows that over 70% of all hacked crypto funds stem from breaches in centralised platforms.

As the space continues to mature, the pressure mounts on exchanges to implement more robust security measures and rethink how custodial risk is managed. The CoinDCX exploit is yet another reminder that in crypto, trust must be backed by transparency and security at every layer.

Source: https://x.com/smtgpt

2) Why is AI engine data the most overlooked real world asset:

What are Real World Assets:

Real-world assets are tangible or intangible assets that originate in the physical or traditional economy, such as property, bonds, or commodities, and are represented on-chain through tokenization. RWA’s serve as the connective tissue between the real economy and the digital world, unlocking liquidity for traditionally illiquid assets.

Why does Web3 data carry value:

It’s because of the 2 best words in the English dictionary - artificial intelligence. Data is not just valuable, it is strategic, and is the next key battleground for the global AI arms race. Companies are competing over clean, human-generated, diverse and global data that can fuel model training and fine-tuning. The big data market size was valued at $325.4 billion in 2023 and is expected to triple over the next 10 years.

How can datasets become tokenized:

Data tokenization turns datasets into blockchain-based assets that can be traded, divided, and verified. Like gold or property, tokenized data can be backed by access rights, licensing revenue, or AI utility.

Key Challenges:

Smart Contracts: Technical setup is easy, but designing contracts to reflect ownership, licensing, and revenue share is complex.

Revenue and Utility: Data tokens gain value from actual usage, such as AI developers paying for access. Building systems to distribute revenue fairly is difficult.

Valuation: Data value depends on factors like quality, uniqueness, and demand. Standard valuation methods are still lacking.

Provenance: It's hard to ensure tokenized data remains accurate and up-to-date, especially with changing datasets.

Privacy and Security: Tokenizing sensitive data raises risks. Strong encryption and access control are essential.

Compliance: Human data tokens must align with privacy laws like GDPR and HIPAA. Legal systems will need to adapt.

Tokenizing data as real-world assets is promising but requires major innovation across technology, legal frameworks, and market standards.

Key Takeaways:

Personally, we think that data as an RWA will be one of the most prominent real world assets in the next few years and the company that can be the leader in the Web3 space will be at least a $10 billion company.

3) A remote Himalayan Kingdom is the gambling on crypto:

Bhutan, a tiny country in Asia, holds the fourth-largest state owned stockpile of Bitcoin in the world. The country is known for its stunning landscapes, gross national happiness index and also their crypto mining ventures.

Bhutan began mining Bitcoin as early as 2018. It doubled down and realized its potential. As of 2021, their portfolio surged to $1.2 billion. A key driver of Bhutan’s crypto push has been the country’s robust hydropower potential. Rivers fed by Himalayan glaciers thunder down Bhutan’s valleys and power the country’s electric grid.

The population is extremely small as they have 750,000 citizens and the introduction of the investment in crypto has helped the country sustain itself over the past few years.

Growth Marketing Tip of the Week: Pricing

99% of pricing goes left to right: Cheap → Middle → Expensive.

But Wine List flipped it. Why?

Founder Josh Lachkovic believes we anchor to the first number we see. So leading with the most expensive tier makes the cheaper ones feel like a better deal.

£99 feels cheaper after you’ve seen £189 - duh.

Recently Funded Companies

Meme’s of the Week

I found a new Twitter meme account and I’m obsessed

Bitcoin to $200k, here we go!

🙃

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!