- W3VE Web3 Hub

- Posts

- ETH'S price blows past $4500 for the first time since 2021

ETH'S price blows past $4500 for the first time since 2021

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Tokenized stock rises 220% in July

According to Binance Research, tokenized stocks are inching toward what could be a $1.3 trillion market. Yes, trillion, with a "T." That’s not just chump change in the couch cushions of TradFi.

Investor demand for blockchain-based financial products is accelerating, pushing tokenized stocks closer to a potential inflection point. These blockchain-native counterparts to traditional equities fall within the broader real-world asset (RWA) tokenization sector, which reached a market capitalization of $370 million by the end of July.

But here's the plot twist: $260 million of that came from just one player, Exodus Movement (EXOD), whose shares were issued via Securitize. Take that out of the equation, and the tokenized stock market still clocked in at $53.6 million, a staggering 220% surge from June.

The growth rate is starting to echo the early DeFi boom when total value locked (TVL) went from $1 billion to $100 billion seemingly overnight between 2020 and 2021.

Over 60 tokenized stocks are now trading across major exchanges like Kraken, Bybit, and even within Solana’s DeFi ecosystem thanks to Backed Finance’s xStocks. These include blue-chip favorites like Amazon, Nvidia, Apple, Tesla, and Microsoft. (basically, your rich tech friends portfolio).

But it’s not just about slapping Wall Street assets onto a blockchain. Mark Greenberg, head of consumer business at Kraken, says the goal is bigger: to go beyond Wall Street and make investing accessible to everyone, not just the guys in suits.

2) Ethereum’s prices blows past $4500 for the first time since 2021

On August 12, Ethereum crossed the $4,500 mark for the first time in over three years, pushing its total market cap to $463.8 billion. That’s a 40% jump since the start of August, and a clear sign that ETH is back in the spotlight.

This rally isn’t just about market momentum. It’s being driven by a combination of strong institutional interest, renewed ETF activity, and a broader shift in how investors are positioning around Ethereum.

One of the biggest drivers behind ETH’s surge has been increasing flows into ETFs offering exposure to digital assets. Investors are moving early, positioning ahead of potential approvals for spot ETH ETFs and the numbers are starting to reflect that confidence.

Institutional Confidence Is Building:

Beyond ETFs, institutional buyers are showing long-term conviction. ETH is increasingly appearing in corporate treasuries, with on-chain data showing a steady rise in large holdings. This isn’t short-term speculation, it’s strategic allocation.

Ethereum Outpacing Bitcoin in Key Areas:

While Bitcoin has been setting new highs this cycle, ETH has been quietly outperforming in recent weeks. Capital rotation is underway, with ETH gaining ground in terms of demand, ETF holdings, and trading volume. The ETH/BTC ETF holdings ratio, in particular, has tripled since May, a signal that investors are leaning into Ethereum’s upside potential.

Ethereum’s breakout is more than just a chart milestone. It reflects changing market dynamics, growing institutional trust, real ETF momentum, and renewed interest in ETH as both a tech platform and a long-term asset.

3) Web3 career trends

Firms are prioritizing hiring for senior roles

Remote work job listings have declined 50% year-on-year.

Demand for non-technical roles has increased, yet technical role salaries remain.

Technical roles still dominate the salary charts, with engineering leading at an average of $140,000, followed by product at $135,000 and data roles at $130,000.

Even the lowest-paid category, “Unknown,” earns a relatively high $90,000 per year.

There’s heavy competition, as the highest-paying positions see intense application rates ten to twenty times higher than other fields.

Remote work:

Once known for their remote-first Web3 jobs, work-from-home roles declined by 50% in 2025 year over year, with companies opting for hybrid models.

The report says 3 to 4 days in the office yields the best results. It says this happened for three key reasons.

The first is that more mature companies (5 to 8 years) that have moved beyond the startup phase benefit from more structured and coordinated teams.

Secondly, anonymous developers created problems in the industry. Despite it being quite a movement among developers, issues stemming from bad actors and poor participation have created a demand for verifiable identities, which are easier handled in-house.

Finally, it explains that seniors at blockchain tech firms need to mentor juniors, and staff also need to meet the demands of cross-functional collaboration.

Growth Marketing Tip of the Week:

Less polished, more authentic

Can test multiple variations

$50k return

Recently Funded Companies

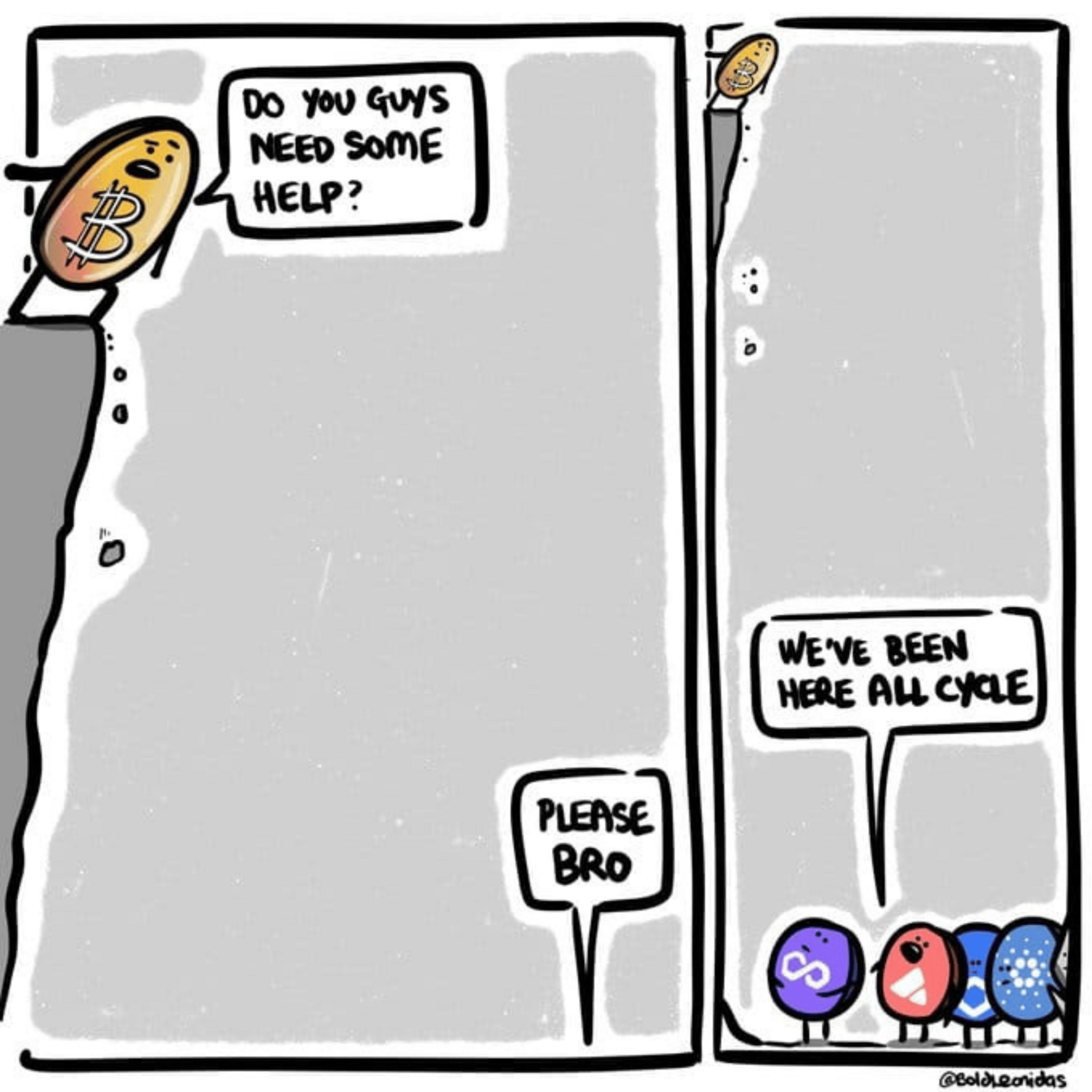

Meme’s of the Week

I refuse to see any red for the next month

Poor alt coins…

🙃

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!