- W3VE Web3 Hub

- Posts

- Ether, Dogecoin, Bitcoin plunge sees $900 million liquidated

Ether, Dogecoin, Bitcoin plunge sees $900 million liquidated

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

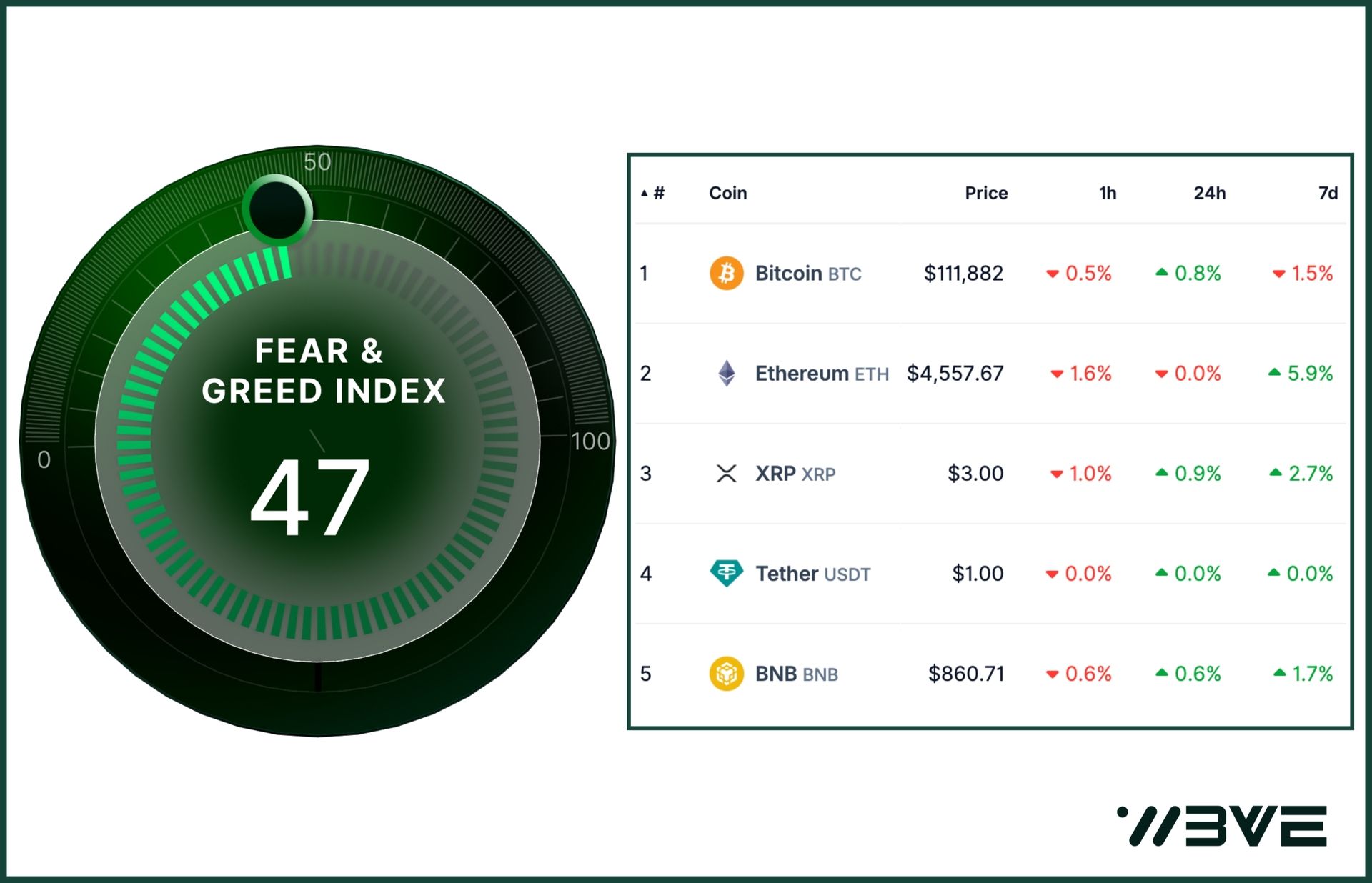

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) Kanye West comes out with crypto token called YZY:

Kanye West, now officially just Ye - has decided that rapping, fashion, and politics weren’t enough. The newest addition to his empire? A cryptocurrency on Solana called Yeezy Money (YZY). He announced it on X with the words: “Yeezy Money is here… a new economy, built on chain.” Translation: Kanye just dropped an album you can’t stream - you can only buy it on-chain.

Within hours of launch, YZY’s market cap hit an eye-watering $2 billion. Apparently, all it takes is a celebrity tweet and a wallet address for crypto degens to throw their life savings at the screen. Somewhere, Vitalik Buterin is quietly crying into his math papers.

According to the official website, YZY isn’t just a coin, it’s an entire ecosystem. There’s Ye Pay, a “low-fee” crypto payments processor, which finally gives you the chance to tip your barber in JPEGs. There’s also a YZY credit card, because who doesn’t want their overdraft linked directly to Kanye’s mood swings? And, naturally, there’s a big bold disclaimer: “This is not an investment.” In crypto, that usually translates to: “This is definitely an investment, but please don’t sue us when it all collapses.” To add a touch of legitimacy, Ye’s official store already lists YZY as a payment option. Yes, you can now buy a $250 hoodie with your speculative Ponzi gains.

Of course, no celebrity coin launch would be complete without insider drama. Blockchain sleuths spotted multiple wallets scooping up YZY seconds after launch, with one flipping $1.5 million profit almost instantly, faster than Kanye flips album release dates. Coinbase director Conor Grogan even estimated that 94% of YZY’s supply is held by insiders, and at one point a single wallet controlled 87%. That’s not decentralization; that’s basically a family business.

So, is this the future of payments or just another celebrity pump-and-dump? On paper, YZY is pitched as “a symbol of support, not an investment.” In practice, it’s a $2B meme coin wrapped in Yeezy branding. But if history has taught us anything, it’s that Kanye can turn absolutely anything into a cultural moment, even a Solana token that looks suspiciously like Dogecoin in designer sneakers.

2) CertiK predicts “endless war” with crypto hackers after $2.5 billion stolen:

Crypto may have the best engineers in the world, but it’s still losing the war against its oldest enemy: human error. Despite billions poured into cybersecurity, 2025 is shaping up to be another record-breaking year for hacks, scams, and exploits. Turns out, the weakest link in Web3 isn’t the code, it’s people clicking the wrong link at 2 a.m.

According to a new report from blockchain security firm CertiK, hackers stole a staggering $2.47 billion in the first half of 2025. That’s already more than the entire haul from 2024, and we’re only halfway through the year. The carnage included 144 incidents in Q2 alone, draining over $800 million, which sounds like a lot, until you realize that’s actually a 52% decrease from Q1. In crypto, “fewer hacks” basically means, “Congrats, only $800 million went missing this time.”

The crown jewel of crypto theft came in February: a $1.4 billion hack on Bybit, now the largest cyber-heist in blockchain history. For scale, that’s bigger than the GDP of some countries, and all it took was one successful exploit. As Ronghui Gu, Columbia professor and CertiK co-founder, put it: “As long as there’s a weak point, attackers will find it.” Translation: if you leave even one window open, hackers will crawl through it, raid the fridge, and steal your NFTs on the way out.

What’s worse, many of these losses aren’t even due to complex zero-day exploits or advanced quantum computing attacks, they’re just people being people. Roughly half of 2024’s security incidents were caused by “operational risks” like private key compromises. In other words, the blockchain itself was fine; Dave from accounting just copied his seed phrase into a Google Doc labeled “Super Secret Passwords.”

Phishing scams are also making a brutal comeback. Just this month, one unlucky investor managed to lose $3 million in USDT with a single click. He thought he was approving a legit transaction, but instead signed away his entire bag to a malicious smart contract. The kicker? He apparently only checked the first and last few characters of the wallet address, the crypto equivalent of checking a stranger’s ID by glancing at the photo and ignoring the name. The scammer switched the middle characters, which most platforms hide for “cleaner UI.” Design aesthetic: 1. Human common sense: 0.

3) There’s a new Web3 sector trending:

Crypto markets kicked off the week with a spectacle that traders know all too well: a rally fuelled by leverage, a sudden pullback, and nearly $900 million in bullish bets wiped out in hours. It’s the kind of drama that reminds everyone why crypto is both exhilarating and terrifying.

The setup was textbook. Ether surged toward $4,700, tempting traders to stack leverage like it was free money. Overnight, however, a dip in the S&P 500 rattled risk assets, pulling the rug from under crypto’s momentum. By morning, Ether had slid back to $4,400, Bitcoin dropped to $110,200, and thousands of over-leveraged longs were unceremoniously liquidated.

Data from Coinglass shows ETH traders took the biggest hit, with more than $320 million wiped out, followed by Bitcoin at $277 million. Solana, XRP, and Dogecoin chipped in with another $90 million combined. It was ugly, but ETH traders were clearly the main course at the liquidation buffet.

The aftermath was just as violent. Volatility spiked as Bitcoin’s daily vol jumped from 15% to 38%, while Ether’s exploded from 41% to 70%. That gap tells the story: ETH rallies tend to attract heavier leverage, but when momentum shifts, those same positions unwind faster, creating sharper, more brutal swings.

Strip away the numbers, and the story is familiar. Crypto has a cycle: markets rally, traders overextend, macro jitters spark a correction, liquidations cascade, and volatility surges. The $900 million flushed this week is simply the latest chapter. As one weary trader quipped in a Telegram chat, “It’s not a crash, it’s just volatility and vibes, bro.”

Growth Marketing Tip of the Week

What are AI ads and are people making money off them:

AI ads are advertisements created and optimized using artificial intelligence. Instead of humans manually writing copy, designing creatives, and testing placements, AI tools can generate text, images, or videos, then automatically target the right audience and adjust campaigns in real time. The goal is to save time, lower costs, and improve results by letting algorithms handle much of the heavy lifting.

Veo 3 is Google’s advanced AI video generator that turns text prompts into high-quality, cinematic-style videos with realistic motion, sound, and even avatars. It’s being used by creators, marketers, and businesses because it can produce professional-looking content in minutes, something that normally takes a production team and big budgets. In short, it does work and has proven effective for fast, quality video output.

Here are the people who are making money using VEO3 (https://veo3.ai):

1) Greenleaf Retail:

Created 47 product-related video’s in a quarter.

Each video costed under $200 (VS ~ $15000 traditionally)

These campaigns generated $2.3 million in additional revenue

2) PJ Accetturo owns an AI ad agency:

Created an AI-generated ad for platform, Kalshi for the NBA finals.

Costed $2000 to make

Reached 18 million impressions in 48 hours

Led to 100’s of new leads.

Lets be real, you can’t replace humans.

So what’s the point of this? We think it should be used as an iteration mechanism to test multiple variations of content and to see what is working and what is not working.

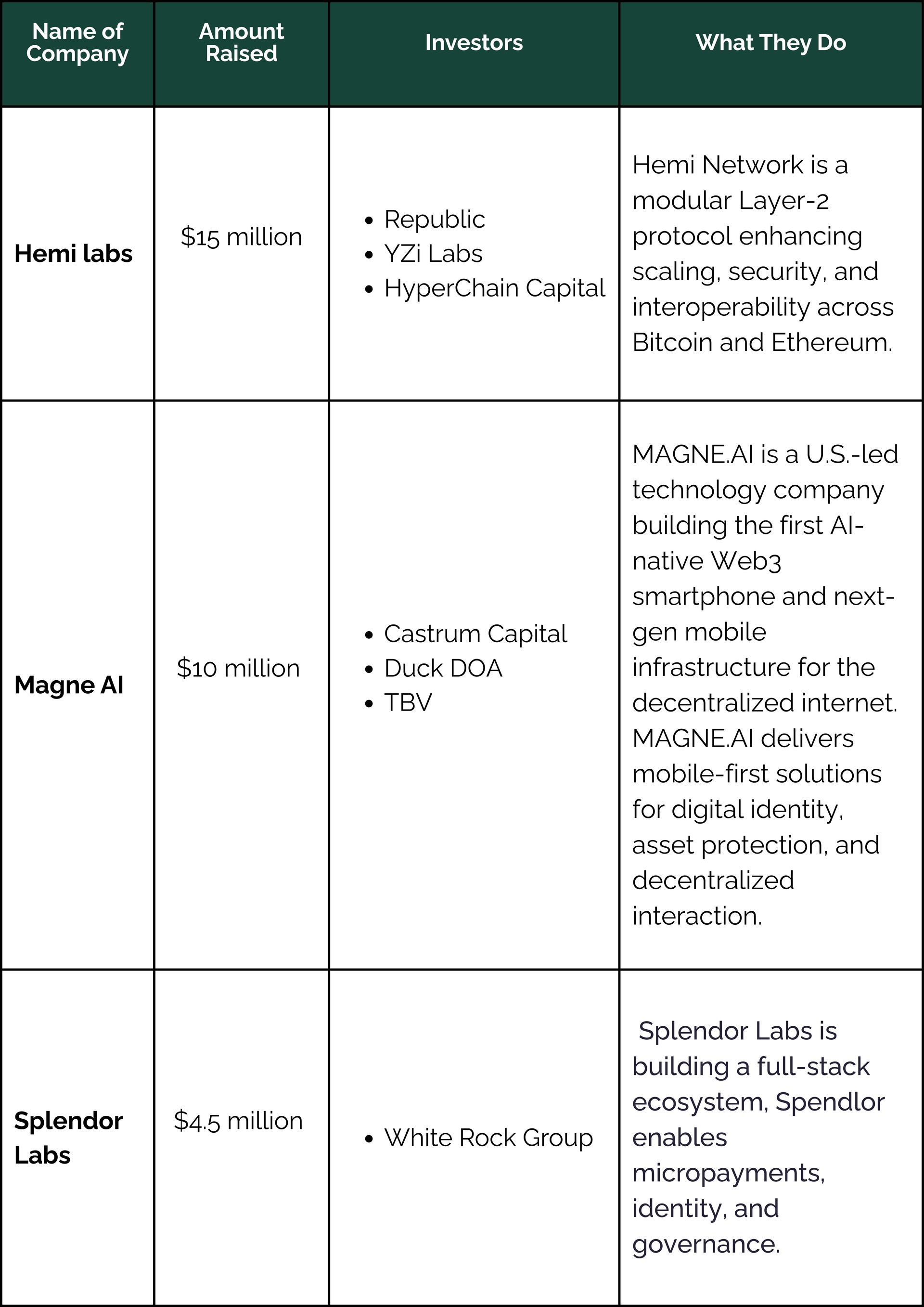

Recently Funded Companies

Meme’s of the Week

mine was $1000 ☹️

The average crypto trading course

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!