- W3VE Web3 Hub

- Posts

- France Says It May Block Crypto Companies From Other Countries

France Says It May Block Crypto Companies From Other Countries

GM,

What the hell is going on with the markets this week?

This is W3VE, your Web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Table of Contents

Company Highlight

Web3 Marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person in-house marketing team without any of the hassle.

Book a call to explore your Web3 goals: W3VE Calendly

Fear & Greed Index

Project power rankings of the week

Market Updates and News

1) France says it may block crypto companies licensed in other countries:

Paris is stirring the crypto pot again. France’s financial watchdog (the AMF) says it might block some crypto firms licensed elsewhere in the EU, meaning that France does not really care what coin is across the pond. Why? Because they think certain countries are playing “regulation-lite” while letting companies passport their licenses across the block. Translation: nobody wants to be the strict parent while the neighbours hand out candy.

Marie-Anne Barbat-Layani, head of the AMF, basically told Reuters: “Look, if you all go easy on them, don’t expect us to let them run wild in Monaco." This is a game of blackjack that the French don’t want to play.

After FTX imploded like a badly coded smart contract, European regulators decided crypto couldn’t just be the Wild West anymore. Sweden’s finance minister, Elisabeth Svantesson, summed it up: Europeans need protection, and regulators need to stop crypto from doubling as a money-laundering service or terrorist piggy bank.

So, the EU wrote new rules:

Want to issue, trade, or safeguard crypto, tokenized assets, or stablecoins? Get a license.

Starting January 2026, every crypto transfer needs names attached, sender and recipient, no matter the amount. Bye-bye, anonymous wallet shuffles.

Member states must now cooperate more on crypto taxation and share info about fancy tax rulings for the ultra-wealthy. (Translation: rich people, no more hiding your bags offshore.)

Crypto firms actually want regulation, at least, they want consistent regulation. Nothing kills vibes like 27 countries playing 27 different rulebooks. So now they’re pushing for harmonized EU rules and even hinting at global standards. (Because, let’s be honest, crypto doesn’t exactly respect borders.)

Personally, we think this emphasizes the centralization in decentralization, but at the same time it's safer in the broader scheme of things. It’s fair to say that the crypto world and the normies are stuck between a rock and a hard place.

2) The London stock exchange launches Blockchain platform for private funds:

The London Stock Exchange Group (LSEG) just pulled a move that could make Wall Street jealous: it launched Digital Markets Infrastructure (DMI), a blockchain-based platform for private funds. Translation: one of the world’s most buttoned-up financial institutions is officially dabbling in tokenization. And here’s the kicker: it’s the first major global stock exchange to roll out something like this. I can just picture Jamie Dimon waiving his fist.

The DMI isn’t just a gimmick. Built with Microsoft (yes, it runs on Azure), the system is designed to cover the entire life cycle of digital assets - issuance, tokenization, and post-trade settlement. Even more interesting, it promises interoperability, letting old-school financial systems and shiny new blockchain rails play nicely together. Private funds are the first guinea pig asset class, but LSEG has plans to expand into others.

The first names on board include MembersCap, which handled the debut transaction, and Archax, a UK FCA-regulated crypto exchange that acted as nominee for the Cardano Foundation. On top of that, Workspace users will be able to “discover” these private funds, connecting general partners with professional investors. The pitch is simple: open up access to private market opportunities that are usually reserved for insiders. This therefore will democratize the private equity industry to allow everyday users to invest in it.

This move highlights how traditional finance is locking arms with blockchain. Nelli Zaltsman, head of blockchain payments innovation at JPMorgan’s Kinexys, put it bluntly: initiatives like this blur the line between TradFi and DeFi, and faster than most people expect. At the RWA Summit in Cannes, she said their goal is always to find ways to work with public blockchains, assuming regulators don’t kill the vibe.

3) Cybersecurity jobs in Web3 are more than 3x the salaries of cybersecurity jobs in Web2:

If you want to get rich in 2025, forget dropshipping and TikTok side hustles, become a Web3 cybersecurity engineer. The highest-paid “white hats” in crypto are pulling in millions, blowing past the $300,000 salary ceiling of traditional cybersecurity jobs.

Bug bounty platform Immunefi says its leaderboard looks more like a Forbes list than a job board. “Researchers are earning millions per year compared to typical cybersecurity salaries of $150k–$300k,” CEO Mitchell Amador told Cointelegraph. Unlike corporate roles with fixed paychecks and HR meetings, white hats in Web3 choose their targets, work their own hours, and earn purely based on the value of the vulnerabilities they uncover.

And the value is staggering. Immunefi has paid out over $120 million across thousands of reports, with thirty researchers already crossing into millionaire status. The biggest single bounty so far? A jaw-dropping $10 million for exposing a fatal flaw in Wormhole’s cross-chain bridge — a bug that could have wiped out billions. Even with that catch, Wormhole still went on to suffer a $321 million exploit in 2022, later leading to a dramatic $225 million “counter exploit” clawback by Jump Crypto and Oasis.app.

Amador says the logic behind the payouts is simple: protocols often secure tens or hundreds of millions, so a single bug can make or break them. Bounties can hit 10% of funds at risk, meaning critical vulnerabilities are essentially lottery tickets for hackers with the skills to find them. Top researchers are making anywhere between $1 million and $14 million, cementing themselves as the “100x hackers” who spot weaknesses others miss.

While early DeFi hacks often came from buggy smart contracts, the game has shifted in 2025. Now the hot exploits are “no-code” attacks… think social engineering, stolen keys, or sloppy operational security. Even so, cross-chain bridges remain the juiciest targets. They’re complicated, hold vast sums, and when they fail, it’s fireworks.

Patterns have emerged. Protocols rushing to market without strong security measures are basically waving a red flag, and even established players get complacent. “DeFi protocols with high TVL and no solid bounty program are the most exposed,” Amador warned. The August numbers back him up: hackers looted $163 million in a single month, up from $142 million in July, with just sixteen attacks. Most of the damage came from two mega incidents - a $91 million social engineering scam that hit a Bitcoiner, and a $50 million breach of Turkish exchange Btcturk.

The bottom line? In crypto, the real money isn’t in trading coins - it’s in safeguarding them. For the elite white hats, 2025 isn’t about a six-figure salary. It’s about turning bugs into multimillion-dollar payouts.

Growth Marketing Tip of the Week

Marketing funnels aren’t flowing. Old tactics aren’t working. Your playbook needs some love. So we rewrote it for you. Loop marketing is a new four-stage approach that combines AI efficiency and human authenticity to drive growth.

Steps:

Express who you are: Define your taste, tone, and point of view.

Tailor your approach: Use AI to make your interactions personal, contextual, and relevant

Amplify your reach: post on multiple channels

Evolve in real time: iterate quickly and effectively

(to learn more about this, W3VE’s doing a course on web3 marketing… so watch this space to grow quickly and effectively)

Recently Funded Companies

Meme’s of the Week

I refuse to see any red for the next month

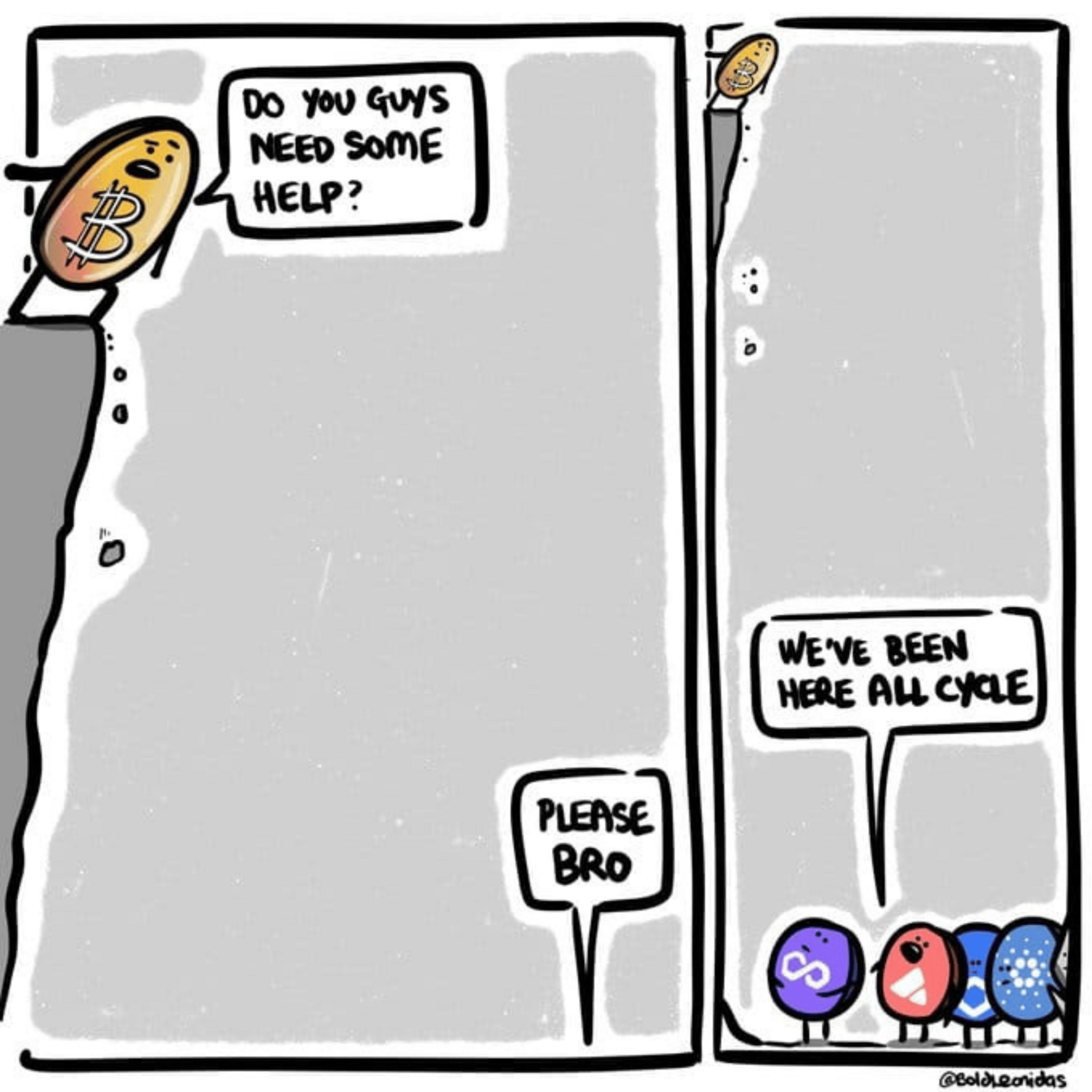

Poor alt coins…

🙃

That’s it for this week.

Keep showing up, keep cheering each other on — and as always, head for the moon!