- W3VE Web3 Hub

- Posts

- You probably should've bought the dip...

You probably should've bought the dip...

GM,

What the hell is going on with the markets this week.

This is W3VE, your web3 whisperer here to translate Web3 jargon into plain Jane simple English.

Company Highlight

Never write an advertisement which you wouldn’t want your own family to read. The consumer isn’t a moron, she’s your wife. You wouldn’t tell lies to your own wife. Don’t tell them to mine.”

To me, you’re family. So I wouldn’t lie to you either.

Web3 marketing is hard. Like really hard. Your community never grows, your engagement is nonexistent and you’re lost in a sea of AI content.

We’ve personally seen W3VE come up in the space and take on giants like StakingCabin who are validators for projects like Sui, Aptos and Cosmos.

That’s why I’m confident in recommending it, because it feels like a 10 person inhouse marketing team without any of the hassle.

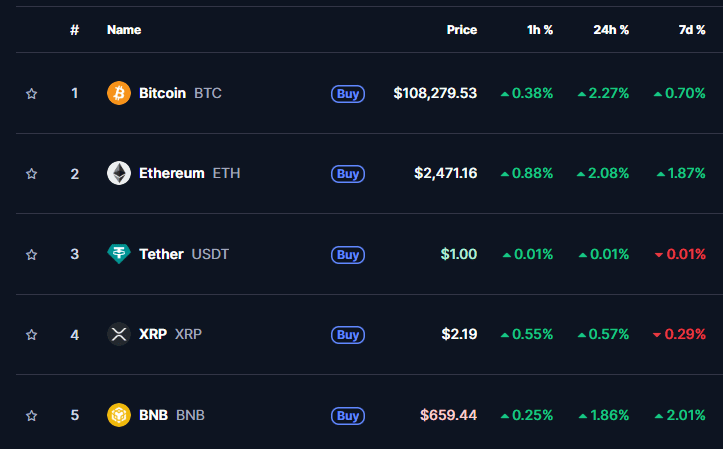

Fear & Greed Index

Source: https://coinmarketcap.com/

Here’s what we’ve got for you today:

1) Project power rankings of the week

2) Market updates and news

3) Growth marketing tip of the week

4) Recent Web3 companies that got funded

5) Meme’s of the week

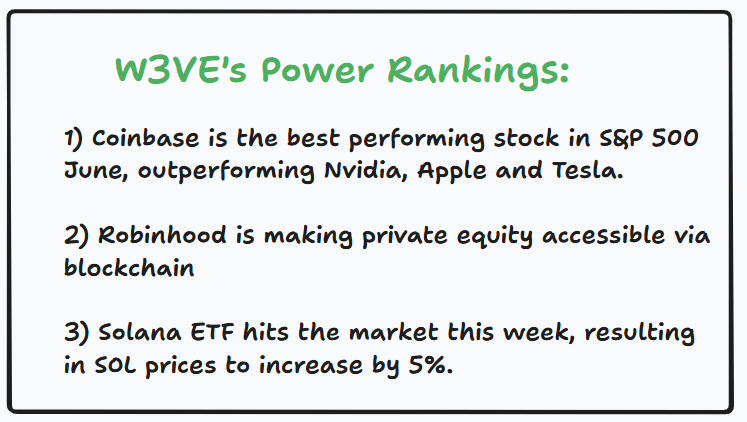

01) Project power ranking’s of the week

Source: https://www.w3ve.com/

02) Market updates and news

1) Bitcoin and Ethereum just had their best Q2 since 2020:

Bitcoin and Ethereum just crushed the sh*t out of Q2 2025, finishing 30% and 36% in the green - we used to pray for times like these.

Bitcoin 1-year price graph:

Ethereum 1-year price graph:

I know what you’re thinking … The ETH graph looks shocking, and you would be right in thinking that. Ethereum finished Q1 2025 with a loss of 45.41%, marking its worst performance since 2022.

The down turn was due to two things:

1) Tensions in the Middle East

2) Tariffs imposed by the Trump administration on China and other countries.

This therefore created economic uncertainty hence people were more inclined to keep cash on hand or to invest in less volatile asset classes.

Why has there been an upturn? Well there are 2 reasons:

1) The tensions in the Middle East have subsided as their is a ceasefire.

2) Crypto’s institutional reframing has increased the value of crypto altogether due to the Stablecoin bill that has been added.

Traditionally, Q1 and Q4 tend to deliver strong results for BTC and ETH, thanks to the 'Santa Claus' effect, which is a burst of year-end optimism. Q2, on the other hand, tends to be more volatile, with outcomes often shaped by policy developments and regulatory activity.

2) Mastercard joins forces with Bitget wallet to release zero-free crypto cards:

Bitget has launched a crypto card that lets users pay directly from their digital wallets using the Bitget Wallet app. It supports real-time payments using on-chain swaps and deposits, and can be used at over 150 Mastercard-accepting merchants worldwide.

Okay, so why is this important?

This is really big as this is the first step to make crypto more practical - let me explain.

If you wanted to spend your Ethereum, the first step you’d have to take was to convert it into fiat currency such as the dollar, now, with this card, you can essentially spend Ethereum as if it was dollars which makes crypto as a currency frictionless.

This has positive implications for the industry as the more people use crypto as a mechanism of payment, it will bridge the gap between web3 and the real world.

3) Robinhood plans to tokenize everything:

I want them to win so badly.

The story of Robinhood is insane, they stick up for the small guy, but there are subplots in the story.

15 years ago, a guy worked at McDonalds flipping burgers during the day and teaching himself how to code at night and then fast forward becomes the senior vice president and the GM of crypto for Robinhood - his name is Johann Kerbrat.

Now, he is heading up the most ambitious crypto project ever.

Robinhood plans on making Private Equity available for everyone and they did this by tokenizing shares of private companies such as OpenAI and Tesla, which are private companies. This is massive because it democratizes finance and allows regular people to take part in financial instruments that they didn’t have access to.

I think this is a brilliant idea because:

1) This breaks down one of the biggest barriers in finance. Traditionally PE is reserved for the ultra-wealthy and institutional investors.

2) Allows liquidity in an illiquid asset class due to the fractional ownership model.

3) It allows real financial inclusion

5

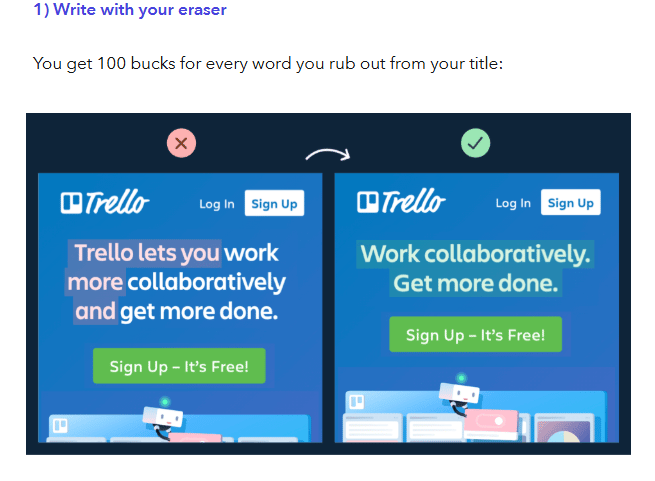

03) W3VE’S growth marketing tips of the week

I’m sure you’ve heard this before, but storytelling is everything.

But don’t take it from me, take it from the founder of a $3 Billion company

“The Virgin story is what people relate to. Great brands and great businesses have to be built around great stories.”

So, how do you become a great storyteller?

The answer is simple, by consuming great stories and learning the frameworks of good storytelling.

Here are 3 tips for great copywriting curtesy of Harry Dry:

04) Recent projects that got funded

Company | Amount Raised | Investors | What They Do |

|---|---|---|---|

dKloud | $3.15 million - | Animoca Blizzard Maven capital | dKloud is a decentralized cloud infrastructure platform that bridges DePIN with enterprise IT |

Makina | $3 million - strategic | Bodhi Ventures Cyber Fund Interop | An AI agent that helps traders execute finance strategies |

Zama | $57 million - series B | Multicoin capital Protocol labs Metaplanet | An open source infrastructure company that supports the development of SAAS and LLM’s |

Bitmine | $250 million - private | Founders fund Mozayyz Pantera | A vertically integrated Bitcoin and Ethereum network company specializing in immersion-cooled mining, synthetic mining contracts, and institutional-grade treasury services |

Datagram | $4 million - pre-seed | Blizzard Animoca Cointelegraph Accelerator | Datagram is a decentralized physical infrastructure network (DePIN) and AI-driven hyper-fabric Layer 1 designed to enable fast, scalable, and permissionless connectivity |

05) Trending meme’s

Real

“Buy the dip guys”

The state of crypto summed up

Thank you so much for reading, for more, join our telegram group :)